📈 $UNH: Down 60%, is it a buy?

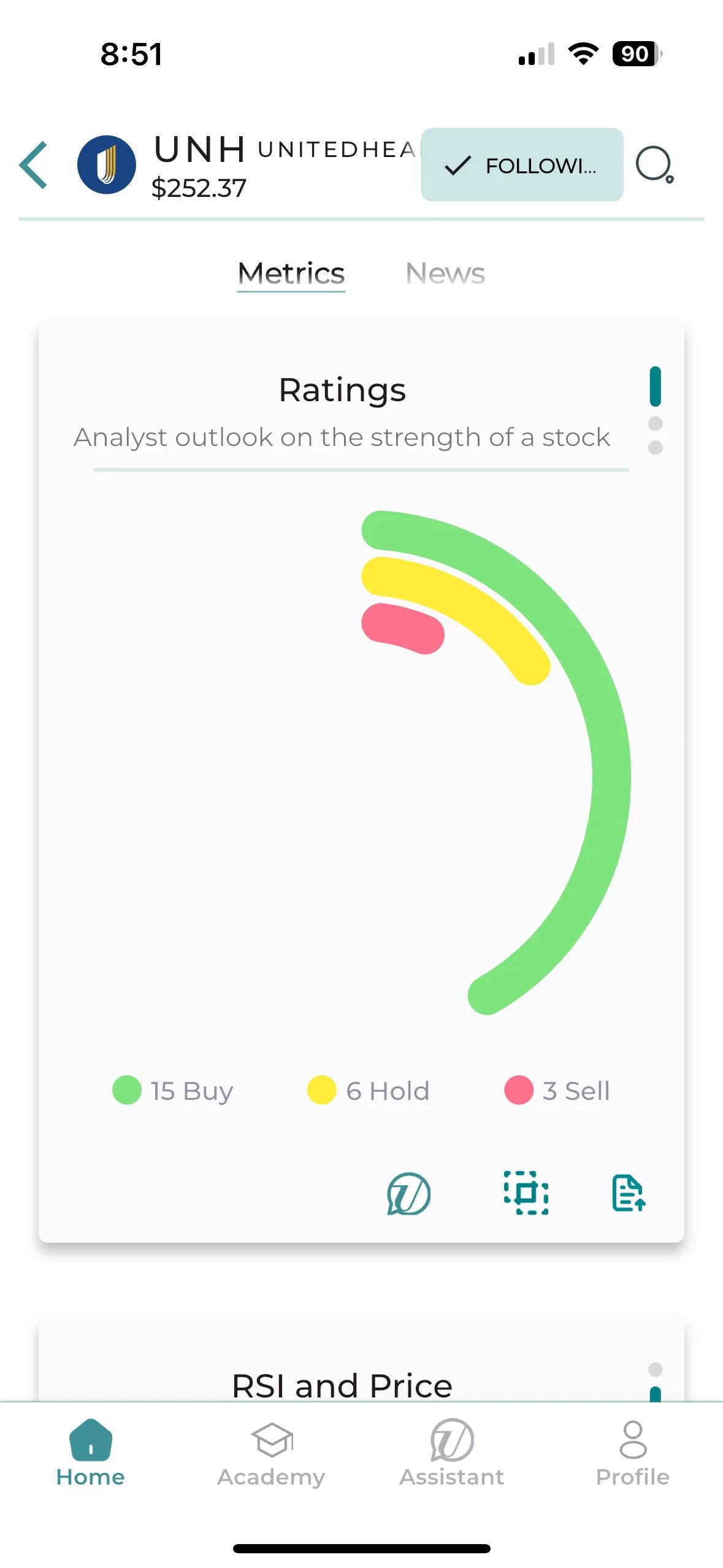

✨ Analysts and banks remain positive

Despite the drop in price, some analyst are maintaining a BUY rating on the stock. JP Morgan has a price target of $310 (20%+). United Health Group is still an essential provider with a vast amount of market share.

The price has dropped 60% from its 52 week high due to rising medical costs which cut its revenue outlook significantly. The company had underpriced plans that actually took on longer hospital stays and more intense procedures.

To counter this, the company plans to:

Integrate its health insurance (United Healthcare) with its health services side (Optum).

This will bring efficiencies as the hospital and health insurance act as one.

Incentivize doctors to deliver more effective and efficient care.

This moves doctors away from more extreme procedures, stays etc that don’t necessarily change health outcomes.

Introducing digital tools for price transparency.

Patients will be able to compare costs of things like MRIs and medicine across hospitals which enables them to choose the best option for them.

Leadership changes to its management team including a new CEO.

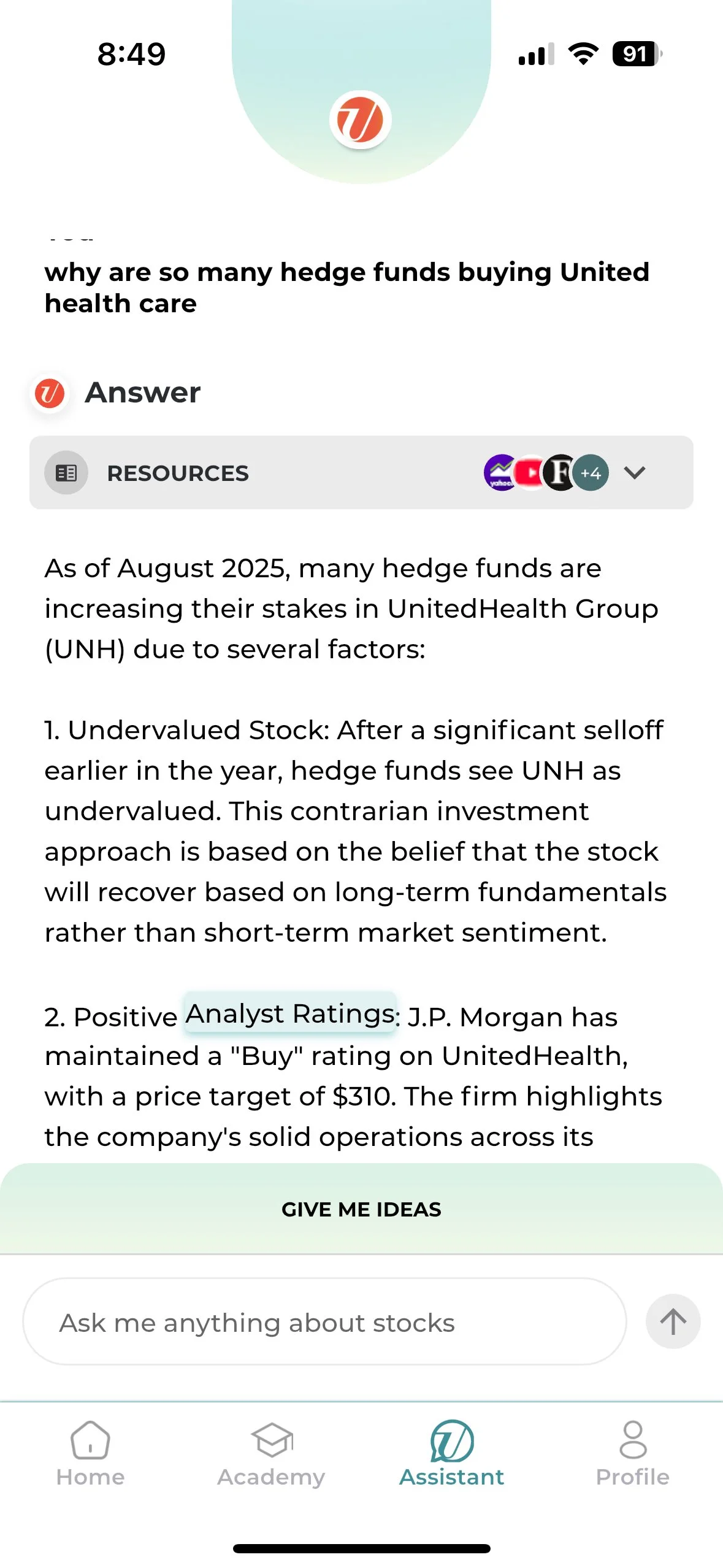

🔮 Ask the Underwriter Assistant 🔮

📈 Positivity from hedge funds

Hedge funds may see United Healthcare as a quality business with strong moats. Its vertically integrated and has had steady financial performance.

The U.S. population is steadily aging, driving an increase in Medicare enrollment.

As a leading provider of Medicare Advantage plans, United Healthcare is strategically positioned to capitalize on this long-term demographic shift. The companies vertical integration (pharmacy benefits, care delivery, insurance) strengthen its market position.

🚀 Buy: The case for buying United Healthcare is more cautious than in the past. The drop in price may be a nice entry for those with a long term view.

⏸️ Hold: Investors may be more cautious to see if United Healthcare’s leadership changes can get a hold of the rise in medical costs.

❗Sell: A sell case could be made for risk-averse investors who are concerned that health costs won’t be manageable in light of an aging population in America.